Is the Hampton Roads housing market cooling off — or heating back up? The honest answer: it depends entirely on where you live. After pulling the January 2026 numbers, what we're seeing is not a crash, and it's not a frenzy. I call it a recalibration. Some cities are stabilizing, some are still very competitive, and one or two are clearly shifting toward a buyer's market.

If you're thinking about buying or selling anywhere in Hampton Roads, here's what the data is actually telling us — city by city.

Mortgage Rates & Affordability

Let's start with mortgage rates, because they're driving almost everything right now. As of early February 2026, 30-year fixed rates are hovering between 6.1% and 6.25% — the

lowest we've seen in over three years. Just a year ago, rates were closer to 6.9%. That's nearly a full percentage point drop, and it makes a meaningful difference in monthly payments.

The Federal Reserve made three cuts at the end of 2025, and lenders are now competing aggressively. Some credit unions and major banks are offering rates below 6% for well-qualified buyers (though it's worth paying attention to associated fees). Are we getting back to 3% rates? Highly unlikely. But affordability is improving, and when you combine slightly lower rates with rising inventory, we're looking at the most favorable buying conditions since early 2022.

If rates continue to drift lower — which many economists expect — buyers who purchase now could have refinancing opportunities later, while sidestepping the frenzy that lower rates could bring. The message isn't "rush." It's "be strategic."

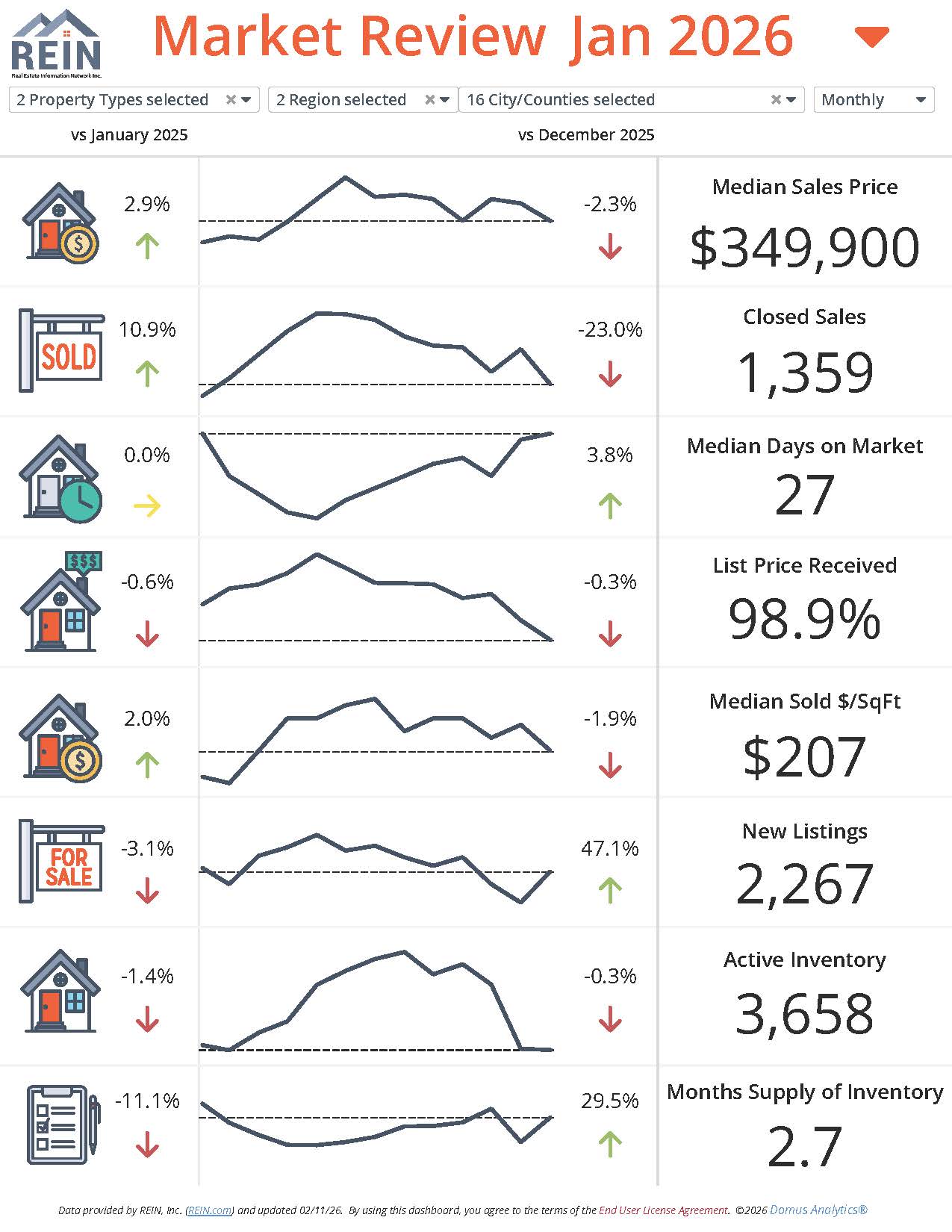

Regional Snapshot: Hampton Roads, January 2026

Here's the headline data for the region as a whole:

- Median sales price: $349,900 (up 2.9% year-over-year)

- Homes sold: 1,359 (up 10.9% from last year)

- Days on market: 27 days

- Inventory: 2.7 months of supply

- Sellers receiving: ~98.9% of list price

A truly balanced market sits around 6 months of inventory. We're at 2.7 — still seller-leaning, but

inventory is up nearly 30% year-over-year, meaning buyers finally have options again. Sales up nearly 11% tells me confidence is returning.

For sellers:

Your home will likely sell and sell relatively quickly if priced properly and prepared correctly. But the days of aggressive overpricing are behind us.

For buyers:

You have more leverage than you've had in years. You can think overnight in some cases, negotiate repairs, and sometimes ask for seller concessions — though strong

homes in strong locations are still moving quickly.

City-by-City Breakdown

Virginia Beach

Median sales price: $397,000 (up 7.3%)

Closed sales: up 21%

Days on market: 19 days

Inventory: 1.9 months | Sellers receiving 99.1% of list

Virginia Beach remains the strongest market in the region. 19 days on market is fast, and 1.9 months of

inventory is tight. That said, sellers are getting about 99% of list price — not the 105% we saw in peak frenzy years — which means pricing strategy matters

once again.

Chesapeake

- Median sales price: $430,000 (up 7.5%)

- Days on market: 28 days

- Closed sales: up 16.4%

- Inventory: 2.5 months | Sellers receiving over 100% of list

Chesapeake continues to show strength. Well-positioned homes are still generating strong offers. Families continue to prioritize schools, space, and newer construction. Buyers have slightly more breathing room than in Virginia Beach, but Deep Creek, Great Bridge, and Greenbrier remain competitive. Also worth noting: builder incentives on newer construction are worth comparing against resale total cost.

Norfolk

- Median sales price: $308,000 (up ~1%)

- Closed sales: up 13.8%

- Days on market: 25 days

- Inventory: 3 months | Sellers receiving 99.1% of list

At a 3-month supply, Norfolk is the closest thing we have to equilibrium in the region. Appreciation has moderated to just 1% year-over-year — a sign of stabilization. Location within Norfolk matters dramatically; Ghent and waterfront properties behave very differently from more price-sensitive areas. For buyers, this is where negotiating power starts to show, especially if walkability and urban lifestyle are priorities.

Suffolk

- Median sales price: $344,235 (down ~10%)

- Days on market: 39 days

- Inventory: 5 months | Sellers receiving 96.7% of list

Suffolk is where we see the biggest shift — and it's clearly leaning toward a buyer's market. Sellers should price strategically from day one; the market will not absorb aspirational pricing right now. For buyers looking for space, land, or newer construction, Suffolk offers real opportunity for disciplined negotiators.

Portsmouth

- Median sales price: $273,000 (up 1.5%)

- Closed sales: up 24.4%

- Days on market: 26 days | Inventory: 2.8 months

Sales volume jumping nearly 25% tells me buyers are recognizing value in Portsmouth. Homes are moving in under a month. Affordability is a key driver here, but neighborhood knowledge is critical — there's strong variation block by block. Portsmouth is active, but selective.

Hampton

- Median sales price: $290,000 (up 5.5%)

- Closed sales: down 4.1%

- Days on market: 39 days | Inventory: 3.1 months

Hampton is quietly gaining momentum, but it's a selective market. Prices are up while sales volume has dipped slightly — buyers are cautious and deliberate. Sellers should expect 30–40 days on market; presentation and pricing precision matter here. Buyers are getting strong value with steady appreciation and enough time on market to evaluate properly. Hampton rewards thoughtful buyers and realistic sellers.

Newport News

- Median sales price: $255,000 (flat year-over-year)

- Closed sales: up 17.4%

- Days on market: 34 days | Sellers receiving 96.8% of

list

Flat pricing combined with rising sales tells me buyers see value in Newport News. This is not an appreciation story — it's a pricing discipline story. At under 97% of list price received, overpricing will cost sellers. For buyers who prioritize space and affordability, this market deserves serious consideration.

Isle of Wight

- Median sales price: $426,000+ (up 23.6%)

- Closed sales: down 45%

- Days on market: 56 days | Sellers receiving 99.9% of

list

Isle of Wight is a niche market that requires specialized guidance. Premium properties still command strong prices, but patience is required — fewer homes are trading at a high price point. For buyers, inventory is limited; if you find the right property, hesitation can cost you months of waiting.

The Big Picture

Hampton Roads is stabilizing. Inventory is rising, appreciation is moderating, buyer confidence is returning, and leverage varies dramatically city by city. We are no longer in a frenzy. We're not in a crash. We're in a recalibration phase.

For sellers:

Pricing, precision, and presentation matter more than they have in years.

For buyers:

You finally have options — but strategy still matters.

Most importantly: Hampton Roads is not one market. It's multiple micro-markets behaving very differently. Every city, every neighborhood tells its own story.

Want Clarity on Your Specific Situation?

If you're trying to figure out what this means for your home or your search, that's a more nuanced conversation than reading headlines. Reach out — I'm happy to walk through

timing, pricing, or buying power in your specific area.